Are you dipping your toes into the world of investing?

And because of that, penny stocks with high promoter holding might have caught your eye.

They’re like hidden gems waiting to be discovered, offering the potential for significant returns. And when you add high promoter holding into the mix, it’s like finding a golden ticket to the investing playground.

So, what exactly does a high promoter holding penny stocks mean?

Let’s break it down. High promoter holding simply means that the founders or key individuals within a company own a substantial chunk of its shares.

This indicates a strong vote of confidence in the company’s future prospects. When these stocks are priced at pennies, they can represent incredible opportunities for growth.

Read more:

Top FII Holding Penny Stocks Under Rs 10:Expert Picks for High Returns

Hidden Dangers of These 3 Multibagger Penny Stocks. BIG NO

Which Penny Stocks Will Boom In 2024? Expose the Covert Gem

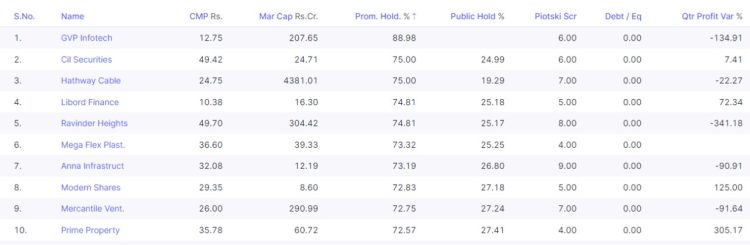

Top 10 Penny Stocks With High Promoter Holding As on 17th Feb 2024

Key Metrics: High Promoter Holding Penny Stocks Screener

1. GVP Infotech Share Price

Market Cap

GVP Infotech boasts a market capitalization of ₹208 Crores

Stock Price

The current stock price stands at ₹12.8

The stock has experienced a 52-week high of ₹44.0 and a 52-week low of ₹9.85

Financial Ratios

Stock P/E (Price-to-Earnings Ratio): A hefty 173 indicates that investors are willing to pay a premium for GVP Infotech’s earnings potential.

Book Value: Each share’s book value is ₹10.3

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): At 2.76%, GVP Infotech’s capital utilization efficiency is modest.

ROE (Return on Equity): The return on equity stands at 2.73%

High Promoter Holding Penny Stocks

Promoter Holding: The promoters hold a significant stake of 89.0% in the company.

Change in Promoter Holding: Recently, there has been a 1.01% decrease in promoter holding.

Piotroski Score: With a score of 6.00, GVP Infotech demonstrates decent financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 36.7

Earning Power: GVP Infotech’s earning power is at 0.68%

Earnings Yield: The earnings yield is 0.60%

Price to Earning: The stock’s P/E ratio remains at 173

Operational Performance and Outlook

Operational Profit Growth: The company has witnessed an impressive 101% growth in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 3.65%

In Summary

GVP Infotech Ltd, headquartered in New Delhi, India, offers a range of IT-related products and services. While its capital utilization and profitability metrics show room for improvement, the company’s strong promoter holding and decent Piotroski score indicate stability. You should closely monitor its performance and industry trends.

Read more:

Paytm Share Price Crash! Verge of Becoming a Penny Stock

Best Penny Stocks For Budget 2024: Unlocking Opportunities

2. CIL Securities Share Price – High Promoter Holding Penny Stocks

Market Cap

CIL Securities Ltd commands a market capitalization of ₹24.7 Crores

Stock Performance

The current stock price stands at ₹49.41.

Over the past year, the stock has oscillated between a 52-week high of ₹61.0 and a 52-week low of ₹23.01.

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 9.73, the stock is reasonably priced relative to its earnings potential.

Book Value: Each share’s book value is ₹55.01

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): A respectable 13.4% indicates efficient capital utilization.

ROE (Return on Equity): The return on equity stands at 10.3%

High Promoter Holding Penny Stocks

Promoter Holding: The promoters maintain a significant stake of 75.0% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 6.00, CIL Securities demonstrates decent financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 20.3

Earning Power: CIL Securities’ earning power is at 6.62%.

Earnings Yield: The earnings yield is 21.6%.

Price to Earning: The stock’s P/E ratio remains at 9.73.

Operational Performance and Outlook

Operational Profit Growth: The company has achieved a modest 4.71% growth in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at an impressive 37.2%.

In Summary

CIL Securities Ltd, part of the CIL Group, offers a range of financial services. While the company’s profitability metrics are encouraging, investors should closely monitor industry trends and the company’s growth trajectory.

Read more:

Unveiling The Hidden Gems: Best Penny Stocks Under Rs 1 [2024]

Penny Stocks For Dummies: Step by Step Ultimate Guide

3. Hathway Cable & Datacom Stock Price – High Promoter Holding Penny Stocks

Market Cap

Hathway Cable & Datacom Ltd boasts a substantial market capitalization of ₹4,381 Crores

Stock Performance

The current stock price stands at ₹24.81.

Over the past year, the stock has witnessed a 52-week high of ₹28.0 and a 52-week low of ₹12.21.

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 81.6, the stock is trading at a premium relative to its earnings potential.

Book Value: Each share’s book value is ₹23.91.

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 2.15%, Hathway’s capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 1.55%

Penny Stocks With High Promoter Holding

Promoter Holding: The promoters maintain a significant stake of 75.0% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 7.00, Hathway demonstrates decent financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 55.9.

Earning Power: Hathway’s earning power is at 1.91%.

Earnings Yield: The earnings yield is 2.25%.

Price to Earning: The stock’s P/E ratio remains at 81.6

Operational Performance and Outlook

Operational Profit Growth: Unfortunately, the company has experienced a decline of -13.0% in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 15.4%.

In Summary

Hathway Cable & Datacom Ltd, headquartered in Mumbai, India, is a prominent player in the cable broadband and television services sector. While its profitability metrics warrant scrutiny, investors should closely monitor industry trends and the company’s strategic initiatives.

4. Libord Finance Ltd

Market Cap

Libord Finance Ltd commands a market capitalization of ₹16.3 Crores

Stock Performance

The current stock price stands at ₹10.41.

Over the past year, the stock has witnessed a 52-week high of ₹11.6 and a 52-week low of ₹4.58

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 12.1, the stock is reasonably priced relative to its earnings potential.

Book Value: Each share’s book value is ₹10.61.

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 0.89%, Libord Finance’s capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 0.52%

Promoter Holding and Piotroski Score

Promoter Holding: The promoters maintain a significant stake of 74.8% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 5.00, Libord Finance demonstrates moderate financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 21.8.

Earning Power: Libord Finance’s earning power is at 4.02%.

Earnings Yield: The earnings yield is 4.12%.

Price to Earning: The stock’s P/E ratio remains at 12.1

Operational Performance and Outlook

Operational Profit Growth: The company has achieved an impressive 186% growth in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 21.7%.

In Summary

Libord Finance Ltd, a Non-Banking Finance Company (NBFC) registered with the RBI, provides a wide range of financial services. While its profitability metrics show room for improvement, investors should closely monitor industry trends and the company’s strategic initiatives.

5. Ravinder Heights Share Price – Debt Free Penny Stocks

Market Cap

Ravinder Heights Ltd boasts a market capitalization of ₹304 Crores.

Stock Performance

The current stock price stands at ₹49.7.

Over the past year, the stock has witnessed a 52-week high of ₹63.9 and a 52-week low of ₹17.0.

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 60.5, the stock is trading at a premium relative to its earnings potential.

Book Value: Each share’s book value is ₹40.1.

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 1.70%, Ravinder Heights’ capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 2.29%.

Promoter Holding and Piotroski Score

Promoter Holding: The promoters maintain a significant stake of 74.8% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 8.00, Ravinder Heights demonstrates strong financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 31.1.

Earning Power: Ravinder Heights’ earning power is at 1.80%.

Earnings Yield: The earnings yield is 1.78%.

Price to Earning: The stock’s P/E ratio remains at 60.5.

Operational Performance and Outlook

Operational Profit Growth: The company has achieved an impressive 73.3% growth in operational profits.

Operating Profit Margin (OPM): Despite challenges, the OPM currently stands at -10.6%.

In Summary

Ravinder Heights Ltd, a real estate development company, focuses on creating residential and commercial spaces. While its profitability metrics warrant scrutiny, investors should closely monitor industry trends and the company’s strategic initiatives.

6. Mega Flex Plastics

Market Cap

Mega Flex Plastics Ltd commands a market capitalization of ₹39.3 Crores.

Stock Performance

The current stock price stands at ₹36.6.

Over the past year, the stock has witnessed a 52-week high of ₹52.4 and a 52-week low of ₹27.0.

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 24.7, the stock is reasonably priced relative to its earnings potential.

Book Value: Each share’s book value is ₹41.6.

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 6.57%, Mega Flex Plastics’ capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 4.72%.

Promoter Holding and Piotroski Score

Promoter Holding: The promoters maintain a significant stake of 73.3% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 4.00, Mega Flex Plastics demonstrates moderate financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 23.1.

Earning Power: Mega Flex Plastics’ earning power is at 4.50%.

Earnings Yield: The earnings yield is 7.12%.

Price to Earning: The stock’s P/E ratio remains at 24.7.

Operational Performance and Outlook

Operational Profit Growth: Unfortunately, the company has experienced a decline of -86.4% in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 0.85%.

In Summary

Mega Flex Plastics Ltd, engaged in the plastics industry, manufactures and supplies a variety of plastic products. While its profitability metrics warrant scrutiny, investors should closely monitor industry trends and the company’s strategic initiatives.

7. Anna Infrastructures Share Price – Debt Free Penny Stocks

Market Cap

Anna Infrastructures Ltd commands a market capitalization of ₹12.2 Crores

Stock Performance

The current stock price stands at ₹32.1

Over the past year, the stock has witnessed a 52-week high of ₹42.5 and a 52-week low of ₹7.59

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 20.0, the stock is reasonably priced relative to its earnings potential.

Book Value: Each share’s book value is ₹26.6

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 3.12%, Anna Infrastructures’ capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 2.43%

Promoter Holding and Piotroski Score

Promoter Holding: The promoters maintain a significant stake of 73.2% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 9.00, Anna Infrastructures demonstrates strong financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 31.1.

Earning Power: Anna Infrastructures’ earning power is at 8.03%.

Earnings Yield: The earnings yield is 7.06%.

Price to Earning: The stock’s P/E ratio remains at 20.0.

Operational Performance and Outlook

Operational Profit Growth: The company has achieved an impressive 274% growth in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 48.0%.

In Summary

Anna Infrastructures Ltd, headquartered in New Delhi, India, is engaged in real estate development. While its profitability metrics warrant scrutiny, investors should closely monitor industry trends and the company’s strategic initiatives.

8. Modern Shares & Stockbrokers – Penny Stocks With High Promoter Holding

Market Cap

Modern Shares & Stockbrokers Ltd commands a market capitalization of ₹8.60 Crores

Stock Performance

The current stock price stands at ₹29.4

Over the past year, the stock has witnessed a 52-week high of ₹41.4 and a 52-week low of ₹14.0

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 28.7, the stock is reasonably priced relative to its earnings potential.

Book Value: Each share’s book value is ₹42.1

Dividend Yield: Currently, the company does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 2.10%, Modern Shares & Stockbrokers’ capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 1.58%

Promoter Holding and Piotroski Score

Promoter Holding: The promoters maintain a significant stake of 72.8% in the company.

Change in Promoter Holding: There has been no recent change in promoter holding.

Piotroski Score: With a score of 5.00, Modern Shares & Stockbrokers demonstrates moderate financial health according to the Piotroski F-Score methodology.

Industry Comparison

Industry PE (Price-to-Earnings Ratio): The industry average PE ratio is 20.3.

Earning Power: Modern Shares & Stockbrokers’ earning power is at 2.82%.

Earnings Yield: The earnings yield is -400% (please verify this unusual value with additional sources).

Price to Earning: The stock’s P/E ratio remains at 28.7.

Operational Performance and Outlook

Operational Profit Growth: The company has achieved a commendable 50.0% growth in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 15.7%.

In Summary

Modern Shares & Stockbrokers Ltd, headquartered in Mumbai, India, offers a range of financial services including retail broking, mutual fund distribution, and equity research. While its profitability metrics warrant scrutiny, investors should closely monitor industry trends and the company’s strategic initiatives.

9. Mercantile Ventures – Debt Free Penny Stocks

Formerly known as MCC Finance Limited, is engaged in the business of leasing properties, providing facility management, and offering manpower services.

Let’s explore some key financial metrics:

Market Cap

The company’s market capitalization stands at ₹291 Crores

Mercantile Ventures Stock Price

The current stock price is ₹26.0. Over the past year, it has ranged from a high of ₹37.1 to a low of ₹15.0

Key Ratios

Stock P/E: At 116, investors are paying a premium for earnings potential.

Book Value: Each share’s book value is ₹31.7

Dividend Yield: The company currently does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a modest 2.54%, capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 4.14%

Penny Stocks With High Promoter Holding

Promoter Holding: The promoters maintain a significant stake of 72.8% in the company.

Piotroski Score: With a score of 7.00, Mercantile Ventures demonstrates decent financial health according to the Piotroski F-Score methodology.

Industry Comparison

Earning Power: The company’s earning power is at 2.18%.

Earnings Yield: The earnings yield is 3.02%.

Operational Profit Growth: The company has achieved a growth of 10.9% in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 5.44%.

In summary, Mercantile Ventures operates in the real estate and facility management sector. Investors should closely monitor industry trends and the company’s strategic initiatives before making any investment decisions.

10. Prime Property Development Corporation

PPDCL is a group that builds divine castles on the land of heaven—EARTH. As a public limited company listed on the Bombay Stock Exchange, PPDCL specializes in high-end urban properties primarily located in the Western suburbs of Mumbai, spanning from Bandra to Goregaon.

Here’s a snapshot of PPDCL’s financial metrics:

Market Cap: The company’s market capitalization stands at ₹60.7 Crores

Stock Price: The current stock price is ₹35.8. Over the past year, it has ranged from a high of ₹37.8 to a low of ₹9.16

Key Ratios

Stock P/E (Price-to-Earnings Ratio): At 4.55, investors are paying a modest multiple for earnings potential.

Book Value: Each share’s book value is ₹44.2

Dividend Yield: The company currently does not offer any dividend yield (0.00%) to its shareholders.

ROCE (Return on Capital Employed): With a minimal 0.21%, capital utilization efficiency is conservative.

ROE (Return on Equity): The return on equity stands at 9.09%

Promoter Holding

Promoter Holding: The promoters maintain a significant stake of 72.6% in the company.

Piotroski Score: With a score of 4.00, PPDCL demonstrates moderate financial health according to the Piotroski F-Score methodology.

Earning Power: The company’s earning power is at 9.34%.

Earnings Yield: The earnings yield is 12.5%.

Operational Profit Growth: The company has achieved remarkable growth of 258% in operational profits.

Operating Profit Margin (OPM): The OPM currently stands at 13.7%.

In summary, PPDCL pioneers the concept of integrated townships in Mumbai, creating high-end residential and commercial properties. Investors should closely monitor industry trends and the company’s strategic initiatives before making any investment decisions.

Remember, investing in penny stocks, especially those with high promoter holding, requires thorough research and a long-term perspective. While the potential for high returns exists, so does the risk of volatility. Always diversify your portfolio and consult with financial experts before making any investment decisions.

Keep your eyes peeled for these high promoter holding penny stocks, and who knows, you might just uncover your ticket to financial success in the stock market jungle.

Happy investing, future stock market wizards!

Disclaimer: The information provided here is for educational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making investment decisions.