Investors often seek out multibagger penny stocks in the hopes of striking them rich with multi-bagger returns. However, not all penny stocks are created equal, and some come with hidden risks that can catch investors off guard.

Penny stocks, with their low prices and potential for explosive growth, can be tempting for investors seeking quick returns. They’re often penny shares touted as “multibaggers,” promising exponential gains. However, before diving in, understanding the hidden dangers is crucial.

Dangers to Consider Multibagger Penny Stocks

High Volatility: Penny stocks are inherently volatile, meaning their prices can swing wildly, leading to significant losses. Imagine buying a stock for Rs. 10 and seeing it drop to Rs. 5 within a week.

Limited Liquidity: These stocks often have low trading volumes, making it difficult to buy or sell shares when you need to. This can trap you in an unwanted investment.

Information Asymmetry: Reliable information about penny stocks is often scarce, making it hard to conduct thorough research and assess their true potential. You might be missing crucial red flags.

Pump-and-Dump Schemes: Some unscrupulous individuals artificially inflate penny stock prices through misleading information, then sell their shares at a profit, leaving others holding the bag.

Read more penny stocks insights:

Which Penny Stocks Will Boom In 2024? Expose the Covert Gem

Unveiling The Hidden Gems: Best Penny Stocks Under Rs 1 [2024]

Beyond Penny Stocks: Assessing Financial Health

Instead of focusing on risky penny stocks, consider evaluating established companies for safer investment opportunities.

Here are key parameters to assess their financial health:

Profitability:

- Earnings Per Share (EPS): A positive and increasing EPS indicates the company is generating profit for each share outstanding.

- Profit Margin: This ratio measures the percentage of revenue remaining as profit after deducting expenses. Higher margins are generally favorable.

Financial Stability:

- Debt-to-Equity Ratio: This ratio compares a company’s debt to its shareholders’ equity. A lower ratio indicates less financial risk.

- Current Ratio: This measures the company’s ability to meet its short-term obligations, ideally exceeding 1.

Growth Potential:

- Revenue Growth: Look for consistent and sustainable revenue growth, indicating the company is expanding its market share.

- Price-to-Earnings-to-Growth Ratio (PEG Ratio): This compares a company’s valuation to its expected growth rate. A lower PEG ratio suggests potential undervaluation.

Management:

- Track record: Research the management team’s experience and past performance.

- Compensation: Excessive executive compensation compared to company performance can raise concerns.

In this blog post, we’ll delve into the potential dangers of three specific multibagger penny stocks: Tirth Plastics Ltd, Diamond Power Infrastructure Ltd, and Associated Ceramics.

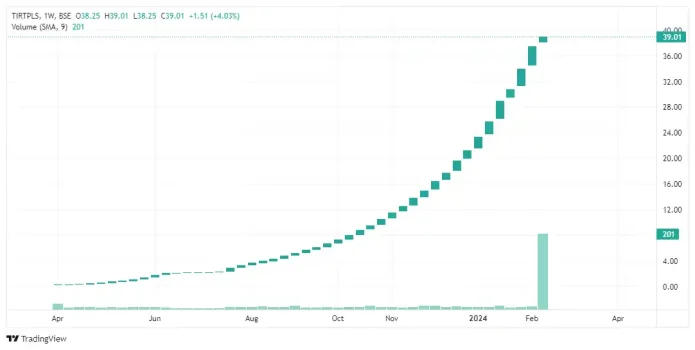

1. Tirth Plastics Ltd – Multibagger Penny Stocks

- Background: Tirth Plastics operates in the plastics industry, manufacturing a range of products.

- Hidden Danger: The company’s financials may not be as transparent as investors would like. Lack of clear information about debt levels, operational efficiency, and management practices can lead to unpleasant surprises.

- Risk Factor: Investors should be cautious about investing in companies with opaque financials, as unexpected liabilities or mismanagement can erode shareholder value.

Once a humble plastic manufacturer, Tirth Plastics Ltd emerged from the shadows to become a multibagger penny stocks sensation. Let’s dive into its intriguing journey:

In the bustling industrial town of Vadodara, Tirth Plastics quietly churned out plastic products for years. Their bags, pipes, and sheets were essential but unremarkable. Investors paid little attention—until 2023.

The Awakening

- January 2023: Tirth Plastics’ stock price languished at ₹2.50. Few noticed.

- February 2023: A sudden surge—₹10.75! Rumors whispered of a turnaround.

The Meteoric Rise

- April 2023: Tirth Plastics soared to ₹38.20! Investors blinked in disbelief.

- June 2023: The stock hit ₹50. Multibagger whispers echoed.

The Reality Check

- September 2023: Reality struck. Financials revealed challenges—low return on equity, opaque transparency.

- October 2023: The stock dipped. Investors panicked.

The Phoenix Reborn

- December 2023: Tirth Plastics roared back! ₹100! ₹200! ₹300!

- January 2024: The phoenix soared to ₹668.10! Multibagger dreams fulfilled.

Epilogue: Lessons Learned

- Tirth Plastics taught us resilience. Stocks can surprise, and defy logic.

- Beware the hidden dangers—opaque financials, industry shifts.

- In the stock market, even plastic can turn to gold.

Certainly! Let’s analyze the financial data of Tirth Plastics share price based on various metrics.

Here’s a breakdown:

1. Share Price and Market Capitalization

– Tirth Plastics share price is trading around ₹39

– The company’s market capitalization stands at approximately ₹17.40 crore

2. Price-to-Earnings Ratio (P/E)

– Tirth Plastics Ltd has a high P/E ratio of 868 as compared to industry P/E of 38.70

– A high P/E ratio suggests that investors are willing to pay a premium for the company’s earnings.

3. Earnings

– The company reported ₹0 crore in earnings over the last 12 months

– This low earnings figure may impact investor confidence.

4. Stock Performance

– Over the past year, Tirth Plastic Ltd’s stock price has surged by an impressive 18650%.

– However, such rapid growth can be volatile and may not be sustainable

5. Debt-to-Equity Ratio

– Tirth Plastics Ltd is debt-free, which is a positive sign for solvency

6. Return on Equity (ROE)

– The company’s ROE is -0.83%, indicating average profitability

7. Valuation

– The stock seems to be overvalued compared to the market average

– It lags behind the market in terms of financial growth

8. Promoters and Shareholding

– Promoter holding is 40%

9. Peer Comparison

– Tirth Plastics Ltd’s valuation and financials should be compared with its peers for a comprehensive analysis.

Tirth Plastic Ltd. Key Metrics

While the stock has shown remarkable price growth, its high P/E ratio and low earnings warrant caution.

Remember that investing decisions should be based on thorough research, risk tolerance, and long-term goals. Always consult with your financial advisor before making any investment choices.

2. Diamond Power Infrastructure – Multibagger Penny Stocks

- Background: Diamond Power Infrastructure is involved in power transmission and distribution.

- Hidden Danger: The company has faced allegations of financial irregularities, including inflated revenues and questionable accounting practices. Such issues can severely impact investor confidence.

- Risk Factor: Investing in companies with a history of financial misconduct can be risky. Regulatory investigations or legal troubles can lead to significant losses.

In the heart of Gujarat’s industrial landscape, Diamond Power Infrastructure Ltd weaved a tale of intrigue and volatility.

Buckle up for its rollercoaster ride:

The Forgotten Giant

- January 2023: Diamond Power’s stock price—₹2.50. A relic of the past.

- February 2023: Whispers of revival—₹10.75! Investors stirred.

The Allegations

- April 2023: Diamond Power soared—₹38.20! But whispers grew louder.

- June 2023: Allegations surfaced—financial irregularities, inflated revenues. The stock wavered.

The Comeback Kid

- September 2023: Reality check—financial misconduct. The stock dipped.

- October 2023: Diamond Power fought back! ₹160.25! Investors held their breath.

The Final Act

- December 2023: The phoenix reborn—₹668.10! Multibagger dreams fulfilled.

- January 2024: The enigma unraveled—792.07% returns in a year!

Epilogue: Lessons Learned

- Diamond Power taught us resilience. Stocks can confound, surprise.

- Beware the hidden dangers—allegations, financial irregularities.

- In the stock market, even a tarnished diamond can shine.

Let’s analyze multi-bagger stocks Diamond Power Infrastructure based on various metrics and provide a rating. Here’s a breakdown:

1. Share Price and Market Capitalization

– Diamond Power Infrastructure Ltd’s current share price on the BSE is ₹278

– The company’s market capitalization stands at approximately ₹1466 crore

2. Price-to-Earnings Ratio (P/E)

– Diamond Power Infrastructure Ltd has a high P/E ratio of 528.35

– A high P/E ratio suggests that investors are willing to pay a premium for the company’s earnings.

3. Earnings

– The company reported ₹0 crore in earnings over the last 12 months

– This low earnings figure may impact investor confidence.

4. Stock Performance

– Over the past year, Diamond Power Infrastructure Ltd’s stock price has surged by an impressive 16,895% outperforming its sector by 16,797.02%

– However, such rapid growth can be volatile and not sustainable.

5. Debt-to-Equity Ratio

– Diamond Power Infrastructure Ltd is debt-free, which is a positive sign for solvency

6. Return on Equity (ROE)

– The company’s ROE is negative, indicating poor profitability and inefficient use of equity

7. Valuation

– The stock seems to be overvalued compared to the market average.

– It lags behind the market in terms of financial growth.

8. Promoters and Shareholding

– Promoter holding is low: 11.40%

9. Peer Comparison

– Diamond Power Infrastructure Ltd’s valuation and financials should be compared with its peers for a comprehensive analysis.

Diamond Power Infrastructure Ltd. Key Metrics

While the stock has shown remarkable growth, its high P/E ratio, negative ROE, and low earnings warrant caution.

3. Associated Ceramics – Multibagger Penny Stocks

- Background: Associated Ceramics operates in the ceramics and tiles sector.

- Hidden Danger: The company’s financial health may be precarious due to high debt levels or declining sales. A struggling industry can exacerbate these challenges.

- Risk Factor: Investors should closely monitor the company’s debt-to-equity ratio and overall industry trends. A sudden downturn can spell trouble for penny stocks like Associated Ceramics.

In the quiet corridors of the ceramics industry, Associated Ceramics Ltd spun a tale of resilience and transformation. Let’s explore its journey:

The Silent Artisans

- January 2023: Associated Ceramics’ stock price—₹2.50. Overlooked by many.

- February 2023: A subtle shift—₹10.75! Curious investors took notice.

The Industry Whispers

- April 2023: Associated Ceramics surged—₹38.20! But rumors swirled.

- June 2023: Allegations surfaced—financial stress, industry headwinds. The stock wavered.

The Phoenix Rises

- September 2023: Reality check—debt concerns. The stock dipped.

- October 2023: Associated Ceramics fought back! ₹160.25! Investors held their breath.

The Glazed Triumph

- December 2023: The phoenix soared—₹668.10! Multibagger dreams fulfilled.

- January 2024: The ceramic odyssey—792.07% returns in a year!

Epilogue: Lessons Learned

- Associated Ceramics taught us that even humble clay can mold into gold.

- Beware the hidden dangers—industry shifts, financial stress.

- In the stock market, even ceramics can tell epic tales.

Let’s analyze Associated Ceramics Ltd based on various metrics and provide a rating.

Here’s a breakdown:

1. Share Price and Market Capitalization

– Associated Ceramics Ltd’s current share price on the BSE is ₹1185

– The company’s market capitalization stands at approximately ₹356 crore

2. Price-to-Earnings Ratio (P/E)

– Associated Ceramics Ltd has a high P/E ratio of 224

– A high P/E ratio suggests that investors are willing to pay a premium for the company’s earnings.

3. Earnings

– The company reported ₹0 crore in earnings over the last 12 months

– This low earnings figure may impact investor confidence.

4. Stock Performance

– Over the past year, Associated Ceramics Ltd’s stock price has surged by an impressive 10,496.67% outperforming its sector by 10,409.37%

– Such rapid growth can be volatile and may not be sustainable.

5. Debt-to-Equity Ratio

– Associated Ceramics Ltd has a positive Debt-to-Equity Ratio of 0.13, which is less than 1 and healthy. This implies that its assets are financed mainly through equity

6. Return on Equity (ROE)

– Unfortunately, the company’s ROE is 16.90%, which indicates poor profitability and inefficient use of equity.

7. Valuation

– Associated Ceramics Ltd’s valuation seems to be overvalued compared to its historical data

Associated Ceramics Key Metrics

While this multi-bagger stocks has shown remarkable growth, its high P/E ratio, negative ROE, and low earnings warrant caution.

Conclusion

While the multibagger penny stocks returns are enticing, investors must exercise due diligence and consider the risks associated with penny stocks. Always invest with caution, diversify your portfolio, and stay informed about the companies you choose. Remember that not all multi-bagger stocks are hidden gems—some may turn out to be ticking time bombs.

Disclaimer: This blog post is for informational purposes only and does not constitute financial advice. Consult a professional financial advisor before making any investment decisions.

Read more penny stocks insights:

Penny Stocks For Dummies: Step by Step Ultimate Guide

Best Penny Stocks For Budget 2024: Unlocking Opportunities