Let’s dive into the exciting world of penny stocks and uncover which penny stocks will boom in 2024.

Picture this – the stock market is like an ever-changing ocean, and penny stocks are the adventurous surfboards catching everyone’s attention.

As we step into 2024, India’s stock market is buzzing with possibilities, and the big question on everyone’s mind is: What does the Indian stock market have in store for us in 2024?

Which Penny Stocks Will Boom In 2024?

Penny stocks, those little guys with affordable share prices and the promise of shooting up in value are like the roller coasters of the investing world.

They’re the thrill-seekers’ dream, offering a chance at high-risk, high-reward adventures.

However, here’s the catch – you’ve got to spot the hidden gems that can outshine the rest and bring you those sweet returns.

Read More Insights:

Penny Stocks For Dummies: Step by Step Ultimate Guide

Unveiling The Hidden Gems: Best Penny Stocks Under Rs 1 [2024]

Best Penny Stocks For Budget 2024: Unlocking Opportunities

Understanding the Indian Stock Market Dynamics

Before we dive into the nitty-gritty of specific penny stocks, let’s talk about the Indian stock market. It’s a wild ride influenced by economic trends, industry growth, and what the regulators are up to. In 2024, as India’s economy gears up for growth, savvy investors are keeping a close eye on sectors with potential.

Top Sectors to Keep an Eye On in India For 2024

1. Technology and Innovation

India is becoming a hotbed for tech and innovation, making penny stocks in this sector real game-changers. Look out for those companies shaking up traditional industries with their inventive solutions.

2. Renewable Energy

With the whole world going green, penny stocks in renewable energy could be the next big thing. India’s commitment to renewable energy goals adds an extra layer of excitement to this sector.

3. Healthcare and Biotech

Thanks to global health challenges, healthcare and biotech are in the spotlight. Penny stocks in companies cooking up cutting-edge healthcare solutions might just be the dark horses of 2024.

Spotting the Potential Winners

1. Fundamental Analysis

Imagine you’re a detective – dive deep into the financial health, management team, and growth prospects of the penny stocks you’re eyeing. Strong fundamentals are like your secret weapon for predicting future success.

2. Market Sentiment

Think of yourself as a trendsetter. Keep your finger on the pulse of market sentiment and industry trends. Positive vibes towards a specific sector can make a big splash on related penny stocks.

3. Regulatory Environment

Pretend you’re a legal eagle – keep a sharp eye on regulatory changes that might shake things up. Whether it’s regulatory support or roadblocks, they can steer the course of penny stocks.

Types of Penny Stocks to Buy in India

So, when you’re thinking about diving into the world of penny stocks in India, it’s like having three different flavors to choose from: turnaround, speculative, and growth stocks.

Turnaround Stocks:

Imagine you have a friend who’s had a rough patch but is on a mission to turn things around. Similarly, turnaround stocks are shares of companies that have had a bit of a rocky road but are expected to bounce back and make a comeback.

Speculative Stocks

These are the daredevils of the stock market. Speculative stocks are like those mystery boxes – you’re not entirely sure what’s inside, and there’s a certain level of uncertainty about the company’s future prospects. It’s a bit of a gamble, so you might want to be a risk-taker if you’re into these.

Growth Stocks

Think of growth stocks as the go-getters, the overachievers of the bunch. These are shares of companies that are predicted to skyrocket in the future. It’s like investing in a small plant and watching it grow into a massive tree over time.

So, when you’re looking at penny stocks in India, consider which type fits your style – whether you’re into comeback stories, a bit of a thrill, or aiming for big-time growth.

Top 10 Penny Stocks List 2024

It’s crucial to note that penny stocks or multi-bagger shares come with considerable risks, including susceptibility to price manipulation, involvement in pump-and-dump schemes, and liquidity challenges.

Despite these warnings, here’s a list of noteworthy penny stocks ready to skyrocket in 2024:

1. Debock Industries: Where innovation meets industry, Debock stands as a beacon of progress.

Strengths

- Effectively using its capital to generate profit – RoCE has improved in the last 2 years

- Effectively using Shareholders fund – Return on equity (ROE) improving the last 2 year

- Efficient in managing Assets to generate Profits – ROA improving since last 2 year

- Company with Low Debt

- Increasing Revenue every quarter for the past 2 quarters

- Annual Net Profits have improved for the last 2 years

- Company with Zero Promoter Pledge

Weakness

- Degrowth in Revenue and Profit

- Decline in Net Profit with falling Profit Margin (QoQ)

- Decline in Quarterly Net Profit with falling Profit Margin (YoY)

- Declining Net Cash Flow: Companies not able to generate net cash

- Book Value Per Share deteriorating for the last 2 years

- Major fall in TTM Net Profit

- Fall in Quarterly Revenue and Net Profit (YoY)

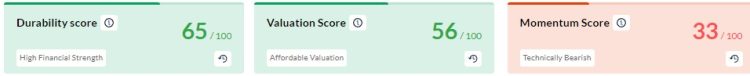

- Weak Momentum: Price below Short, Medium, and Long Term Averages

- Highest fall from 52 Week High

- Sell Zone: Stocks in the sell zone based on days traded at current PE and P/BV

Opportunities

- High Volume, High Gain

- Volume Shockers

Threats

- None

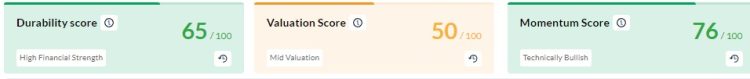

2. Prakash Steelage: Forging strength and resilience, Prakash Steelage epitomizes the backbone of industrial mettle.

Strengths

- Consistent Highest Return Stocks over Five Years – Nifty500

- Stocks with improving cash flow, with good durability

- Companies with Net Profit TTM 5X that of Net Profit in Previous Year

- Book Value per share Improving for the last 2 years

Weakness

- Decline in Net Profit with falling Profit Margin (QoQ)

- Declining Revenue every quarter for the past 2 quarters

- Major fall in TTM Net Profit

- High promoter stock pledges

Opportunities

- High Momentum

- Highest Recovery from 52-Week Low

- Stock with Low PE (PE < = 10)

Threats

- None

3. Accuracy Shipping: Navigating the seas of success, Accuracy Shipping sails with precision and reliability.

Strengths

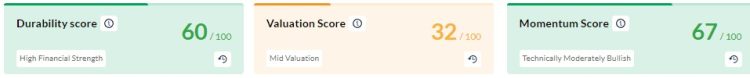

- Strong Momentum: Price above short, medium, and long-term moving averages

- Growth in Net Profit with increasing Profit Margin (QoQ)

- Company with Zero Promoter Pledge

- The stock gained more than 20% in one month

Weakness

- Degrowth in Revenue and Profit

- Decline in Quarterly Net Profit with falling Profit Margin (YoY)

- Major fall in TTM Net Profit

- Fall in Quarterly Revenue and Net Profit (YoY)

Opportunities

- High return technically strong value stocks

- High Momentum

- Negative to Positive growth in Sales and Profit with Strong Price Momentum

- Highest Recovery from 52-Week Low

- Stock with Low PE (PE < = 10)

Threats

- None

4. Comfort Intech: Elevating comfort to a new echelon, Comfort Intech weaves technology seamlessly into everyday life.

Strengths

- Consistent Highest Return Stocks over Five Years – Nifty500

- Effectively using its capital to generate profit – RoCE has improved in the last 2 years

- Company with Low Debt

- Increasing profits every quarter for the past 3 quarters

- Increasing Revenue every quarter for the past 2 quarters

- Book Value per share has improved for the last 2 years

- Company with Zero Promoter Pledge

Weakness

- Inefficient use of shareholder funds – ROE has declined in the last 2 years

- Inefficient use of assets to generate profits – ROA has declined in the last 2 years

- Annual net profit declining for last 2 years

- Sell Zone: Stocks in the sell zone based on days traded at current PE and P/BV

Opportunities

- Stocks seeing monthly price declines, good financial durability, and newly affordable valuations

- Momentum Play

- High Momentum

- Highest Recovery from 52-Week Low

- Weekly Momentum Gainers

Threats

- None

5. Vivanta Industries: Crafters of elegance and quality, Vivanta Industries paints a canvas of sophistication in the business landscape.

Strengths

- Consistent Highest Return Stocks over Five Years – Nifty500

- Effectively using its capital to generate profit – RoCE has improved in the last 2 years

- Effectively using Shareholders fund – Return on equity (ROE) improving the last 2 year

- Efficient in managing Assets to generate Profits – ROA improving since last 2 year

- Company with Low Debt

- Strong cash-generating ability from core business – Improving Cash Flow from operation for the last 2 years

- Company able to generate Net Cash – Improving Net Cash Flow for last 2 years

- Annual Net Profits have improved for the last 2 years

- Company with Zero Promoter Pledge

Weakness

- Negative profit growth, promoters decreasing shareholding QoQ

- Decline in Net Profit with falling Profit Margin (QoQ)

- Decline in Quarterly Net Profit with falling Profit Margin (YoY)

Opportunities

- High Momentum

- Highest Recovery from 52-Week Low

Threats

- None

6. G G Engineering: At the crossroads of precision and innovation, G G Engineering shapes the future of engineering excellence.

Strengths

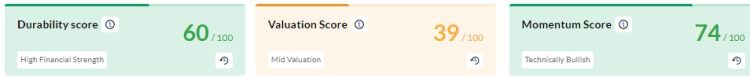

- Strong Momentum: Price above short, medium, and long-term moving averages

- Strong Annual EPS Growth

- Stocks with improving cash flow, with good durability (subscription)

- Growth stocks with good technicals

- Growth stocks, promoters increasing shareholding

- Overbought by Money Flow Index (MFI)

- Company with Low Debt

- Company able to generate Net Cash – Improving Net Cash Flow for last 2 years

- Company with Zero Promoter Pledge

- Recent Results: Growth in Operating Profit with an increase in operating margins (YoY)

- Near 52 Week High

- The stock gained more than 20% in one month

Weakness

- Poor cash generated from core business – Declining Cash Flow from Operations for the last 2 years

- Decline in Net Profit (QoQ)

- Decline in Quarterly Net Profit with falling Profit Margin (YoY)

Opportunities

- High Momentum

- Highest Recovery from 52-Week Low

- RSI indicates price strength

- Stocks near 52 Week High with Significant Volumes

Threats

- None

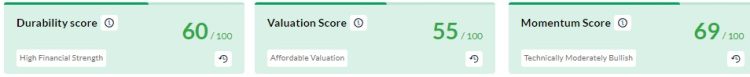

7. Indian Infotech & Software: Pioneers in the digital realm, Indian Infotech & Software crafts the code for a dynamic and connected world.

Strengths

- Strong Momentum: Price above short, medium, and long-term moving averages

- Consistent Highest Return Stocks over Five Years – Nifty500

- Company with high TTM EPS Growth

- Strong Annual EPS Growth

- Effectively using its capital to generate profit – RoCE has improved in last 2 years

- Effectively using Shareholders fund – Return on equity (ROE) improving since last 2 year

- Efficient in managing Assets to generate Profits – ROA improving since last 2 year

- Company with Low Debt

- Annual Net Profits have improved for the last 2 years

- Book Value per share has improved for the last 2 years

- Company with Zero Promoter Pledge

- Recent Results: Growth in Operating Profit with an increase in operating margins (YoY)

- The stock gained more than 20% in one month

Weakness

- Poor cash generated from core business – Declining Cash Flow from Operations for the last 2 years

- Decline in Net Profit (QoQ)

- Declining Net Cash Flow: Companies not able to generate net cash

Opportunities

- High return technically strong value stocks

- High Momentum stocks

- Highest Recovery from 52-Week Low

- RSI indicates price strength

Threats

- None

8. Vikas Ecotech: Fostering sustainable solutions, Vikas Ecotech leads the charge towards an eco-friendly future.

Why we chose penny stock Vikas Ecotech: SWOT Analysis

Strengths

- Strong Momentum: Price above short, medium, and long-term moving averages

- Strong Annual EPS Growth

- Effectively using Shareholders fund – Return on equity (ROE) improving since last 2 year

- Efficient in managing Assets to generate Profits – ROA improving since last 2 year

- Growth in Net Profit with increasing Profit Margin (QoQ)

- Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

- Company with Low Debt

- Annual Net Profits have improved for the last 2 years

- Company with Zero Promoter Pledge

Weakness

- Degrowth in Revenue and Profit

- The decline in Quarterly Net Profit (YoY)

- Declining Net Cash Flow: Companies not able to generate net cash

- Fall in Quarterly Revenue and Net Profit (YoY)

Opportunity

- 30 Day SMA crossing over 200 Day SMA, and current price greater than open

- High Momentum Scores (Technical Scores greater than 50)

- Results Screener: Stocks with upcoming results that are seeing positive shifts in share price

- Negative to Positive growth in Sales and Profit with Strong Price Momentum

- RSI indicates price strength

- Biggest Price Gainers from Open

- Volume Shockers

Threats

- None

9. Seacoast Ship: On the horizon of maritime success, Seacoast Ship sets sail with resilience and vision.

Strengths

- Growth in Net Profit with increasing Profit Margin (QoQ)

- Growth in Quarterly Net Profit with increasing Profit Margin (YoY)

- Company with Low Debt

- Increasing profits every quarter for the past 2 quarters

- Company with Zero Promoter Pledge

- The stock gained more than 20% in one month

Weakness

- Declining Net Cash Flow: Companies not able to generate net cash

Opportunities

- Undervalued Growth Stocks

- Affordable Stocks with High ROE and Momentum

- High Momentum Scores (Technical Scores greater than 50)

- Highest Recovery from 52-Week Low

- RSI indicates price strength

Threats

- None

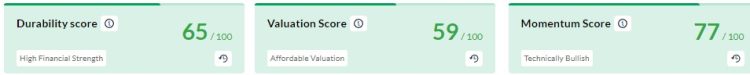

10. Jaiprakash Power Ventures: Powering progress and illuminating possibilities, Jaiprakash Power Ventures stands tall in the energy landscape.

Strengths

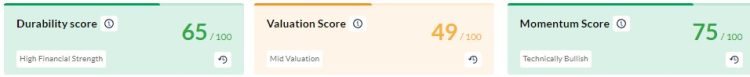

- Strong Momentum: Price above short, medium, and long-term moving averages

- Consistent Highest Return Stocks over Five Years – Nifty500

- Good quarterly growth in the recent results

- Companies with Net Profit TTM 5X that of Net Profit in Previous Year

- Growth in Net Profit with increasing Profit Margin (QoQ)

- Book Value per share has improved for the last 2 years

- FII / FPI or Institutions increasing their shareholding

- Recent Results: Growth in Operating Profit with an increase in operating margins (YoY)

- Near 52 Week High

Weakness

- Inefficient use of shareholder funds – ROE has declined in the last 2 years

- Inefficient use of assets to generate profits – ROA has declined in the last 2 years

- Declining Net Cash Flow: Companies not able to generate net cash

- Annual net profit declining for last 2 years

- Companies with High Promoter Pledge

- High promoter stock pledges

Opportunities

- 30 Day SMA crossing over 200 Day SMA, and current price greater than open

- Momentum Play Screener – Weekly Strategy

- Best Bargains Screener: Above line growth, Below line valuations

- Companies that saw improvement in net profits, operating profit margin, and revenues in the most recent quarter

- High return technically strong value shares

- High Momentum

- Negative to Positive growth in Sales and Profit with Strong Price Momentum

- Highest Recovery from 52-Week Low

- RSI indicates price strength

- Stocks near 52 Week High with Significant Volumes

Threats

- None

Each of these stocks tells a unique story, a narrative of resilience, innovation, and the promise of a bright financial future.

These are some of the best penny stocks ready to skyrocket. So, watch them carefully.

In Conclusion

As we set sail into the unpredictable waters of predicting the next big penny stock boom in India for 2024, bring your enthusiasm and a dash of caution. Successful penny stock adventures require thorough research, a deep understanding of the market, and the ability to navigate the twists and turns.

Remember, penny stocks are like wild dolphins in this dynamic and risky ocean of investments. With the right strategy and some detective work, those substantial gains could be right within your reach. So, keep an eagle eye on the sectors we talked about, and who knows – you might just uncover the hidden gems that’ll steal the spotlight in India’s penny stock saga. Happy investing, adventurers!

Disclaimer: Your use of this blog or our services implies acceptance of our disclaimer. Decisions in the stock market are entirely at your risk; Akme Analytics [akme.co.in], its associates, or employees are not liable for any losses. Information herein is not for buying or selling securities.

Content may be viewed, printed, or copied for personal, non-commercial use only. Reproduction, distribution, or any other form of dissemination is strictly prohibited.

Akme Analytics content is not financial advice; seek professional advice before decisions. Results aren’t guaranteed, and trading involves inherent risks. Past performance doesn’t ensure future results; any investment is solely at your own risk.