In the realm of stock investments, top FII holding penny stocks often present an intriguing opportunity for investors seeking high returns.

These low-priced equities can offer significant upside potential, particularly when backed by institutional investors like Foreign Institutional Investors (FIIs).

In this blog post, we’ll delve into the world of penny stocks with high FII holding, specifically focusing on the top picks favored by FIIs.

Whether you’re a seasoned investor or just starting out, understanding these expert picks could provide valuable insights for your investment journey.

Exploring the Appeal of Penny Stocks

Penny stocks, typically defined as stocks trading at a very low price per share, have long captivated investors with their potential for exponential growth.

While they often come with higher volatility and greater risk, they can also deliver substantial rewards for those willing to navigate the market carefully.

With vast resources and expertise, frequently identify promising penny stocks with high FII holding that may have gone unnoticed by individual investors.

Read more on penny stocks:

Hidden Dangers of These 3 Multibagger Penny Stocks. BIG NO

Which Penny Stocks Will Boom In 2024? Expose the Covert Gem

Unveiling The Hidden Gems: Best Penny Stocks Under Rs 1 [2024]

The Role of FII holdings in penny stocks Investments

FIIs play a significant role in the stock market, wielding substantial influence through their large-scale investments.

These institutional investors conduct in-depth research and analysis before allocating funds, making their picks particularly noteworthy for retail investors.

When FII holdings in penny stocks increase, it’s often viewed as a stamp of approval, signaling potential value and growth opportunities.

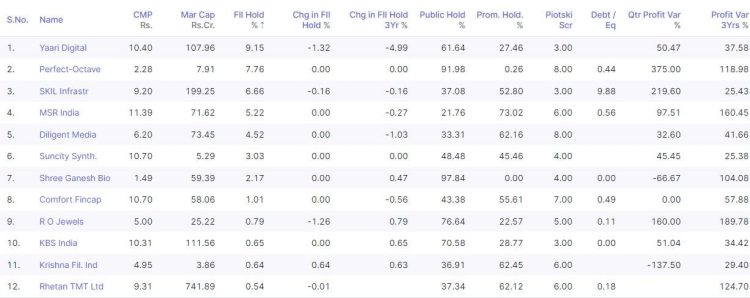

Expert Picks: Top FII Holding Penny Stocks Under Rs 10 As On 15th Feb 2024

Here is a screenshot of the best penny stocks with high FII holding screener

1. Yaari Digital

Despite being a penny stock, Yaari Digital has captured the attention of FIIs due to its impressive growth trajectory in the digital media sector.

With a strong focus on user engagement and content creation, Yaari Digital has seen a substantial increase in its user base, reflecting positively on its revenue streams.

FII holdings in penny stocks like Yaari Digital underscores confidence in its ability to capitalize on the burgeoning digital market.

Yaari Digital Integrated Services Ltd., a leader in B2B marketplace facilitation in India, has seen its share price fluctuate in recent months.

While currently trading at ₹10.30, let’s analyze the key data points to understand what might be driving its valuation:

Financials:

- Market Cap: ₹107 Cr. (relatively low compared to industry peers)

- Current Price: ₹10.30

- High/Low: ₹16.70/₹9.35 (recent volatility)

- P/E Ratio: -22.0 (negative due to losses)

- Book Value: ₹-22.0 (negative due to accumulated losses)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 174% (high return on capital employed)

- ROE: Negative (due to losses)

- Debt to Equity: NA (data unavailable)

Shareholding:

- Promoter Holding: 27.5% (stable holding)

- Penny Stocks With High FII Holding: 9.15% (recent decrease)

- Change in FII Holding: -1.32% (moderately bearish signal)

- Change in FII Holding 3Yr: -4.99% (significant decrease over time)

Industry Comparison:

- Industry P/E: 39.0 (higher than Yaari’s)

- Earnings Power: -11.6% (negative earnings growth)

- Earnings Yield: -1.72% (negative, indicating losses)

Analysis:

Several factors are at play in Yaari’s current valuation:

- Positives: High ROCE indicates efficient capital utilization, and the B2B e-commerce space offers immense growth potential.

- Negatives: Negative P/E and ROE highlight ongoing losses, and the recent decrease in FII holdings suggests reduced investor confidence.

- Industry Comparison: Yaari’s valuation is significantly lower than the industry average, potentially indicating undervaluation or reflecting higher risks.

Investing in Yaari Digital involves a balancing act. While the company operates in a promising industry with efficient capital usage, its consistent losses and declining FII interest raise concerns. Thorough due diligence and understanding the underlying risks are crucial before making investment decisions.

2. Perfect-Octave – Penny Stocks Under Rs 10

Perfect-Octave stands out in the penny stock landscape for its disruptive innovations in the music industry. Leveraging advanced technology and data analytics, Perfect-Octave offers unique solutions for content creators and music enthusiasts alike.

FII interest in Perfect-Octave reflects recognition of its potential to revolutionize the music streaming and production landscape, driving substantial value for investors.

Perfect-Octave Media Projects Ltd., operating in India’s entertainment and media industry, might pique the interest of both seasoned and amateur investors for different reasons.

Let’s dissect the data to understand its potential:

Financials:

- Market Cap: ₹7.91 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹2.28 (relatively low compared to industry)

- High/Low: ₹2.95/₹1.55 (recent volatility)

- P/E Ratio: 29.3 (moderate compared to industry)

- Book Value: ₹2.31 (positive, indicating value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 4.53% (moderate return on capital employed)

- ROE: 5.17% (positive, indicating profitability)

- Debt to Equity: 0.44 (manageable debt levels)

Shareholding:

- Promoter Holding: 0.26% (low control, potential concern)

- Penny Stocks With High FII Holding: 7.76% (moderate holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: 0% (consistent holding over time)

Industry Comparison:

- Industry P/E: 21.4 (lower than Perfect-Octave’s)

- Earnings Power: 3.19% (positive growth)

- Earnings Yield: 3.40% (positive, indicating profitability)

Analysis:

For Savvy Investors:

- Upsides: Low market cap offers high-growth potential, positive ROE, and earnings yield suggesting profitability, and manageable debt levels.

- Downsides: Low promoter holding indicates possible lack of control, moderate P/E might not reflect significant undervalued potential.

For Amateur Investors:

- Positives: Positive book value and moderate P/E offer some value proposition, recent stability in FII holding suggests cautious optimism.

- Cautions: Micro-cap size carries high risk, low promoter holding raises concerns, and thorough research, and risk tolerance are crucial.

Perfect-Octave presents a complex puzzle for investors. While its profitability, manageable debt, and industry potential are attractive, the micro-cap size, low promoter holding, and moderate P/E require careful consideration. Savvy investors can potentially leverage its growth potential, while amateurs should proceed with caution and thorough research.

3. SKIL Infrastructure

SKIL Infrastructure has garnered FII backing for its strategic positioning in the infrastructure development sector. With a diverse portfolio of projects spanning transportation, energy, and real estate, SKIL Infrastructure demonstrates resilience amidst economic uncertainties.

FII investment in SKIL Infrastructure highlights confidence in its ability to capitalize on government initiatives and infrastructure spending, driving long-term growth.

SKIL Infrastructure Ltd., operating in India’s infrastructure sector, presents a unique picture for both seasoned and new investors. Let’s delve into the data to assess its potential:

Financials:

- Market Cap: ₹199 Cr. (mid-cap, offering moderate risk and reward)

- Current Price: ₹9.20 (near its 52-week low)

- High/Low: ₹10.00/₹2.75 (significant volatility)

- P/E Ratio: 68.2 (high compared to industry)

- Book Value: ₹9.14 (positive, indicating value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 0.21% (low return on capital employed)

- ROE: Data unavailable

- Debt to Equity: 9.88 (high debt levels, potential concern)

Shareholding:

- Promoter Holding: 52.8% (high control, potential advantage)

- Penny Stocks With High FII Holding: 6.66% (moderate holding, recent slight decrease)

- Change in FII Holding: -0.16% (neutral signal)

- Change in FII Holding 3Yr: -0.16% (consistent holding over time)

Industry Comparison:

- Industry P/E: 30.2 (significantly lower than SKIL’s)

- Earnings Power: 0.97% (slow growth)

- Earnings Yield: 1.45% (low, indicating low profitability)

Analysis:

For Savvy Investors:

- Upsides: High promoter holding offers stability, recent price near lows present a potential buying opportunity, infrastructure sector holds long-term growth potential.

- Downsides: High P/E ratio suggests overvaluation, low ROCE, and earnings yield raise profitability concerns, and high debt levels pose a financial risk.

For Amateur Investors:

- Positives: Positive book value offers some value proposition, mid-cap size provides moderate diversification, and long-term industry potential exists.

- Cautions: High debt and low profitability require careful consideration, the P/E ratio suggests potential overvaluation, thorough research, and risk tolerance are crucial.

SKIL presents a challenging proposition for investors. While its promoter holding, industry potential, and recent price lows are attractive, the high debt, low profitability, and overvalued P/E ratio demand caution. Savvy investors can potentially explore it as a long-term play after meticulous analysis, while amateurs should exercise significant caution and prioritize thorough research.

4. MSR India

As a key player in the Indian real estate market, MSR India has attracted FII attention for its robust project pipeline and strong market presence.

Despite challenges in the real estate sector, MSR India has maintained steady growth, driven by demand for residential and commercial properties.

FII investment in MSR India reflects optimism about the company’s ability to navigate market dynamics and deliver value to shareholders.

MSR India Ltd., a player in the copper trading and manufacturing space, presents a mixed bag for investors. Let’s analyze the data to understand its potential:

Financials:

- Market Cap: ₹71.4 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹11.4 (relatively volatile)

- High/Low: ₹15.3/₹6.75 (significant historical fluctuation)

- P/E Ratio: N/A (negative earnings make calculation irrelevant)

- Book Value: ₹2.20 (positive, indicating some value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: -20.8% (negative return on capital employed, concerning)

- ROE: 15.9% (positive, but potentially misleading due to negative earnings)

- Debt to Equity: 0.56 (moderate debt levels)

Shareholding:

- Promoter Holding: 73.0% (very high control, potential advantage or concern)

- Penny Stocks With High FII Holding: 5.22% (moderate holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: -0.27% (slight decrease over time)

Industry Comparison:

- Industry P/E: 20.2 (not applicable to MSR due to negative earnings)

- Earnings Power: -21.4% (negative growth, a major concern)

- Earnings Yield: -6.76% (negative, indicating losses)

Analysis:

For Savvy Investors:

- Upsides: Micro-cap offers high-growth potential, positive book value suggests some underlying value, and moderate debt levels provide flexibility.

- Downsides: Negative ROCE and earnings raise serious profitability concerns, high promoter holding might limit liquidity, industry trends, and competition need careful evaluation.

For Amateur Investors:

- Positives: Moderate debt and positive book value offer limited comfort, industry has long-term potential.

- Cautions: Negative earnings, high volatility, and limited information require extreme caution and extensive research. This is not a suitable investment for risk-averse individuals.

MSR India presents a highly speculative opportunity. While its micro-cap nature and industry potential might entice some, the negative earnings, high volatility, and limited information demand significant caution. Savvy investors can potentially consider it after in-depth due diligence and understanding the underlying risks. Amateur investors should prioritize safer options and avoid this highly risky investment.

5. Diligent Media – Penny Stocks Under Rs 10

Diligent Media’s strategic focus on digital transformation has positioned it as a prominent player in the media industry.

With a diversified portfolio of digital assets and a strong brand presence, Diligent Media has experienced significant growth in online readership and advertising revenue.

FII investment in Diligent Media underscores confidence in its ability to adapt to changing consumer preferences and capitalize on digital opportunities.

Diligent Media Corporation Ltd., operating in the Indian print and digital media landscape, presents an intriguing case for investors. Let’s dissect the data to understand its potential:

Financials:

- Market Cap: ₹72.7 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹6.14 (relatively low compared to industry)

- High/Low: ₹7.17/₹2.07 (significant historical volatility)

- P/E Ratio: 5.07 (low compared to industry, potentially undervalued)

- Book Value: ₹-33.0 (negative due to accumulated losses, major concern)

- Dividend Yield: 0% (no dividends paid)

- ROCE and ROE: Data unavailable (limits comprehensive analysis)

- Debt to Equity: Data unavailable (further information needed)

Shareholding:

- Promoter Holding: 62.2% (high control, potential advantage or concern)

- Penny Stocks With High FII Holding: 4.52% (moderate holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: -1.03% (slight decrease over time)

Industry Comparison:

- Industry P/E: 21.4 (significantly higher than Diligent Media’s)

- Earnings Power: 8.35% (positive growth)

- Earnings Yield: 3.76% (positive, indicating profitability)

Analysis:

For Savvy Investors:

- Upsides: Low P/E ratio suggests potential undervaluation, positive earnings growth and yield indicate profitability, micro-cap offers high-growth potential.

- Downsides: Negative book value raises serious concerns about financial health, lack of ROCE and ROE data limits complete analysis, high promoter holding might restrict liquidity.

For Amateur Investors:

- Positives: Positive earnings and yield offer some comfort, industry has long-term potential.

- Cautions: Negative book value, missing financial data, and high volatility require extreme caution and extensive research. This is not a suitable investment for risk-averse individuals.

Diligent Media presents a complex picture with both positive and negative aspects. While its low P/E, positive earnings, and micro-cap nature might be attractive, the negative book value, missing data, and high volatility demand significant caution. Savvy investors can potentially consider it after in-depth due diligence and understanding the underlying risks. Amateur investors should prioritize safer options and avoid this highly risky investment.

6. Suncity Synth

Suncity Synth has emerged as a frontrunner in the synthetic materials industry, attracting FII interest for its innovative products and sustainable practices.

With a focus on research and development, Suncity Synth has expanded its product offerings and market reach, driving revenue growth and profitability.

FII investment in Suncity Synth reflects recognition of its technological leadership and growth potential in the global market.

Suncity Synthetics Ltd., operating in the polyester and nylon manufacturing space, presents a unique challenge for investors. Let’s analyze the data to unpack its potential:

Financials:

- Market Cap: ₹5.29 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹10.7 (relatively volatile)

- High/Low: ₹12.2/₹5.24 (significant historical fluctuation)

- P/E Ratio: N/A (negative ROE makes calculation irrelevant)

- Book Value: ₹-0.51 (negative, indicating accumulated losses)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 4.25% (low return on capital employed)

- ROE: -600% (extremely negative, a major concern)

- Debt to Equity: Data unavailable (further information needed)

Shareholding:

- Promoter Holding: 45.5% (moderate control)

- Penny Stocks With High FII Holding: 3.03% (low holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: 0% (consistent holding over time)

Industry Comparison:

- Industry P/E: 20.3 (not applicable to Suncity due to negative ROE)

- Earnings Power: 2.76% (slow growth)

- Earnings Yield: 1.48% (low, indicating low profitability)

Analysis:

For Savvy Investors:

- Upsides: Micro-cap offers high-growth potential, positive ROCE suggests some efficient capital usage, industry has long-term potential.

- Downsides: Negative book value and ROE raise serious concerns about financial health, lack of debt data limits complete analysis, low promoter holding and FII interest might limit liquidity.

For Amateur Investors:

- Positives: Positive ROCE offers a glimmer of hope, industry has long-term potential.

- Cautions: Extremely negative ROE, missing financial data, and high volatility require extreme caution and extensive research. This is not a suitable investment for risk-averse individuals.

Suncity Synthetics presents a highly speculative opportunity. While its micro-cap nature and industry potential might entice some, the negative financial health, missing data, and high volatility demand immense caution. Savvy investors can potentially consider it after thorough due diligence and understanding the underlying risks. Amateur investors should prioritize safer options and avoid this highly risky investment.

7. Shree Ganesh Biotech India Ltd – Penny Stocks Under Rs 10

Shree Ganesh Bio’s cutting-edge biotechnology solutions have positioned it as a key player in the healthcare sector.

With a strong emphasis on research and innovation, Shree Ganesh Bio has developed a diverse pipeline of products addressing critical medical needs.

FII investment in Shree Ganesh Bio underscores confidence in its ability to deliver breakthrough therapies and create long-term value for stakeholders.

Shree Ganesh Biotech India Ltd., operating in the biotechnology sector, presents a unique case with its zero promoter holding and interesting financial metrics. Let’s analyze the data to understand its potential:

Financials:

- Market Cap: ₹59.4 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹1.49 (relatively low compared to industry)

- High/Low: ₹1.89/₹0.70 (significant historical fluctuation)

- P/E Ratio: 141 (high compared to industry, potentially overvalued)

- Book Value: ₹1.57 (positive, indicating some value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 4.42% (moderate return on capital employed)

- ROE: 3.33% (positive, but low compared to P/E)

- Debt to Equity: 0.00 (no debt, a positive sign)

Shareholding:

- Promoter Holding: 0.00% (no promoter control, a major concern)

- Penny Stocks With High FII Holding: 2.17% (low holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: 0.47% (slight increase over time)

Industry Comparison:

- Industry P/E: 33.7 (significantly lower than Shree Ganesh’s)

- Earnings Power: 0.55% (slow growth)

- Earnings Yield: 0.71% (low, indicating low profitability)

Analysis:

For Savvy Investors:

- Upsides: No debt offers financial flexibility, positive book value suggests some underlying value, micro-cap nature allows for high-growth potential.

- Downsides: Zero promoter holding raises significant concerns about management and control, high P/E ratio suggests potential overvaluation, low profitability and earnings growth require careful evaluation.

For Amateur Investors:

- Positives: No debt and positive book value offer limited comfort, industry has long-term potential.

- Cautions: Zero promoter holding, high P/E, and low profitability demand extreme caution and extensive research. This is not a suitable investment for risk-averse individuals.

Shree Ganesh Biotech presents a highly speculative opportunity with a unique risk profile. While its no-debt structure and micro-cap nature might be attractive, the zero promoter holding, high P/E, and low profitability demand immense caution. Savvy investors can potentially consider it after in-depth due diligence and understanding the underlying risks, especially regarding management and control. Amateur investors should prioritize safer options and avoid this highly risky investment.

8. Comfort Fincap

Comfort Fincap’s robust performance in the financial services sector has attracted FII interest for its strong fundamentals and growth prospects.

With a focus on customer-centric services and prudent risk management, Comfort Fincap has expanded its market share and profitability.

FII investment in Comfort Fincap reflects optimism about its ability to capitalize on opportunities in the dynamic financial services landscape.

Comfort Fincap Ltd., operating in the financial services sector, presents a mix of positive and negative aspects for investors. Let’s analyze the data to understand its potential:

Financials:

- Market Cap: ₹58.5 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹10.8 (relatively low compared to historical highs)

- High/Low: ₹25.3/₹6.47 (significant historical volatility)

- P/E Ratio: 10.9 (moderate compared to industry)

- Book Value: ₹9.81 (positive, indicating value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 13.3% (good return on capital employed)

- ROE: 10.2% (positive and profitable)

- Debt to Equity: 0.49 (moderate debt levels)

Shareholding:

- Promoter Holding: 55.6% (high control, potential advantage or concern)

- Penny Stocks With High FII Holding: 1.01% (low holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: -0.56% (slight decrease over time)

Industry Comparison:

- Industry P/E: 21.0 (higher than Comfort Fincap’s)

- Earnings Power: 12.4% (healthy growth)

- Earnings Yield: 12.1% (high, indicating good profitability)

Analysis:

For Savvy Investors:

- Upsides: Moderate P/E and high Earnings Yield suggest potential undervaluation, good profitability and capital efficiency, industry has long-term growth potential.

- Downsides: High promoter holding might limit liquidity, micro-cap size carries inherent risks, recent price volatility requires careful evaluation.

For Amateur Investors:

- Positives: Moderate P/E, good profitability, and industry potential offer some comfort.

- Cautions: Micro-cap size and high volatility demand caution, thorough research, and risk tolerance assessment are crucial.

Comfort Fincap presents a balanced opportunity with both attractive and concerning aspects. While its financials seem promising, the micro-cap nature and high promoter holding require careful consideration. Savvy investors can potentially explore it after in-depth due diligence and understanding the risks. Amateur investors should prioritize safer options unless they have a high-risk tolerance and have conducted thorough research.

9. R O Jewels – Penny Stocks Under Rs 10

R O Jewels’ strategic positioning in the jewelry market has garnered FII backing for its strong brand equity and growth potential.

With a focus on craftsmanship and design innovation, R O Jewels has differentiated itself in a competitive market environment.

FII investment in R O Jewels highlights confidence in its ability to capture market share and drive shareholder value.

R O Jewels, operating in the Indian jewelry industry, offers a fascinating case study for investors. Let’s delve into the data to assess its potential:

Financials:

- Market Cap: ₹25.7 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹5.09 (relatively low compared to industry)

- High/Low: ₹7.99/₹3.11 (significant historical volatility)

- P/E Ratio: 7.38 (low compared to industry, potentially undervalued)

- Book Value: ₹2.66 (positive, indicating value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 20.4% (excellent return on capital employed)

- ROE: 18.1% (highly profitable)

- Debt to Equity: 0.11 (very low debt, a positive sign)

Shareholding:

- Promoter Holding: 22.6% (moderate control, potential advantage or concern)

- Penny Stocks With High FII Holding: 0.79% (low holding, recent decrease)

- Change in FII Holding: -1.26% (neutral signal)

- Change in FII Holding 3Yr: 0.79% (slight increase over time)

Industry Comparison:

- Industry P/E: 39.0 (significantly higher than R O Jewels’)

- Earnings Power: 26.6% (impressive growth)

- Earnings Yield: 17.2% (high, indicating strong profitability)

Analysis:

For Savvy Investors:

- Upsides: Low P/E and high Earnings Yield suggest potential undervaluation, excellent profitability and capital efficiency, industry has long-term potential.

- Downsides: Low promoter holding raises questions about long-term commitment, micro-cap size carries inherent risks, recent price volatility and decreasing FII interest require careful evaluation.

For Amateur Investors:

- Positives: Strong financial metrics, low debt, and industry potential offer some comfort.

- Cautions: Micro-cap size, low promoter holding, and volatility demand caution, thorough research and risk tolerance assessment are crucial.

R O Jewels presents a compelling opportunity with intriguing financial figures. While its profitability, low debt, and industry potential are attractive, the micro-cap nature, decreasing FII interest, and low promoter holding require significant caution. Savvy investors can potentially consider it after extensive due diligence and understanding the risks involved. Amateur investors should prioritize safer options unless they have a high-risk tolerance and have conducted thorough research.

10. KBS India

KBS India’s diversified business model and strong market presence have positioned it as a preferred choice for FII investment.

With interests in various sectors including manufacturing, infrastructure, and services, KBS India demonstrates resilience and adaptability in challenging market conditions.

FII investment in KBS India underscores confidence in its diversified revenue streams and growth trajectory.

KBS India Ltd., operating in the Indian construction space, presents a complex picture for investors. Let’s analyze the data to understand its potential:

Financials:

- Market Cap: ₹112 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹10.3 (relatively low compared to historical highs)

- High/Low: ₹14.4/₹5.82 (significant historical volatility)

- P/E Ratio: N/A (negative earnings make calculation irrelevant)

- Book Value: ₹3.14 (positive, indicating some value)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 0.79% (low return on capital employed)

- ROE: 0.60% (negative earnings impact calculation)

- Debt to Equity: 0.00 (no debt, a positive sign)

Shareholding:

- Promoter Holding: 28.8% (moderate control, potential advantage or concern)

- Penny Stocks With High FII Holding: 0.65% (low holding, recent stability)

- Change in FII Holding: 0% (neutral signal)

- Change in FII Holding 3Yr: 0.65% (slightly increase over time)

Industry Comparison:

- Industry P/E: 19.9 (not applicable to KBS due to negative earnings)

- Earnings Power: -1.37% (negative growth)

- Earnings Yield: -0.47% (negative, indicating losses)

Analysis:

For Savvy Investors:

- Upsides: Zero debt offers financial flexibility, positive book value suggests some underlying value, and micro-cap nature allows for high-growth potential if profitability improves.

- Downsides: Negative earnings and profitability raise serious concerns, low ROCE and ROE indicate inefficient capital usage, and moderate promoter holding might limit liquidity.

For Amateur Investors:

- Positives: No debt and positive book value offer limited comfort, the industry has long-term potential.

- Cautions: Negative earnings, ROCE, and ROE demand extreme caution and extensive research. This is not a suitable investment for risk-averse individuals.

KBS India presents a highly speculative opportunity with a concerning financial profile. While its no-debt structure and micro-cap nature might be attractive, the negative earnings, profitability, and low efficiency require immense caution. Savvy investors can potentially consider it after in-depth due diligence and understanding the underlying risks, especially regarding business turnaround plans. Amateur investors should avoid this highly risky investment.

11. Krishna Filament Industries – Penny Stocks Under Rs 10

Krishna Fil Ind’s strategic focus on industrial development and technological innovation has attracted FII interest in its growth potential.

With a diverse portfolio of products catering to industrial applications, Krishna Fil Ind has maintained steady growth amidst economic fluctuations.

FII investment in Krishna Fil Ind reflects optimism about its ability to capitalize on emerging market trends and drive value for shareholders.

Krishna Filament Industries presents a fascinating case study for investors, blending positive signs with significant risks. Let’s delve into the data to understand its potential:

Financials:

- Market Cap: ₹3.86 Cr. (micro-cap, suitable for high-risk, high-reward strategies)

- Current Price: ₹4.95 (relatively low compared to historical highs)

- High/Low: ₹5.86/₹2.41 (significant historical volatility)

- P/E Ratio: 129 (high, potentially indicating overvaluation)

- Book Value: ₹-3.60 (negative, concerning)

- Dividend Yield: 0% (no dividends paid)

- ROCE: 200% (very high, exceeding industry average)

- ROE: Data unavailable (unable to assess profitability)

- Face Value: ₹10.00

Shareholding:

- Promoter Holding: 62.4% (high control, potential advantage or concern)

- Penny Stocks With High FII Holding: 0.64% (low holding, recent increase)

- Change in FII Holding: 0.64% (increased recently)

- Change in FII Holding 3Yr: 0.63% (slight increase over time)

Industry Comparison:

- Industry P/E: 30.4 (significantly lower than Krishna Filament’s)

- Earning Power: 4.00% (positive growth)

- Earnings Yield: 0.45% (low, indicating low profitability)

Analysis:

For Savvy Investors:

- Upsides: High ROCE suggests efficient capital usage, positive earning power indicates growth potential, industry has long-term potential.

- Downsides: Negative book value raises concerns about financial health, high P/E ratio suggests potential overvaluation, lack of ROE data hinders profitability assessment.

For Amateur Investors:

- Positives: High ROCE and industry potential offer some hope.

- Cautions: Negative book value, high P/E ratio, and lack of ROE data demand extreme caution and thorough research. This is not a suitable investment for risk-averse individuals.

Krishna Filament Industries presents a complex opportunity with a mix of positive and negative signs. While its high ROCE, earning power, and industry potential are intriguing, the negative book value, high P/E ratio, and lack of ROE data raise serious concerns. Savvy investors can potentially consider it after extensive due diligence and understanding the underlying risks, especially regarding financial health and future profitability. Amateur investors should avoid this highly risky investment.

12. Rhetan TMT

Rhetan TMT’s leadership position in the steel manufacturing sector has garnered FII backing for its strong fundamentals and growth prospects.

With a focus on quality and innovation, Rhetan TMT has established itself as a trusted supplier to various industries.

FII investment in Rhetan TMT highlights confidence in its ability to capitalize on infrastructure development and industrial expansion.

Rhetan TMT, a well-established player in the Indian TMT bar market, presents a blend of established operations and growth potential. Let’s analyze the data to form an informed opinion:

Financials:

- Market Cap: ₹733 Cr. (mid-cap, offering moderate risk and reward)

- Current Price: ₹9.20 (relatively stable compared to historical highs)

- High/Low: ₹15.8/₹7.30 (experienced significant volatility)

- P/E Ratio: 135 (high compared to industry, potentially overvalued)

- Book Value: ₹1.09 (positive, indicating some underlying value)

- Dividend Yield: 0.00% (no dividends paid)

- ROCE: 11.0% (moderate return on capital employed)

- ROE: 9.95% (positive and profitable)

- Debt to Equity: 0.18 (healthy debt levels)

Shareholding:

- Promoter Holding: 62.1% (strong control, potential advantage or concern)

- Penny Stocks With High FII Holding: 0.54% (low holding, recent stability)

- Change in FII Holding: -0.01% (neutral signal)

- Change in FII Holding 3Yr: Data unavailable (unable to assess long-term FII interest)

Industry Comparison:

- Industry P/E: 22.7 (significantly lower than Rhetan TMT’s)

- Earning Power: 7.37% (positive growth)

- Earnings Yield: 1.15% (low, indicating moderate profitability)

Analysis:

For Savvy Investors:

- Upsides: Established brand, moderate debt, and positive financial metrics suggest stability, industry has long-term potential for growth.

- Downsides: High P/E ratio suggests potential overvaluation, lack of recent FII interest data limits understanding, promoter holding might limit liquidity.

For Amateur Investors:

- Positives: Established brand and industry potential offer some comfort.

- Cautions: High P/E ratio and lack of recent FII data demand caution, thorough research and risk tolerance assessment are crucial.

Rhetan TMT presents a balanced opportunity with established strengths and a premium valuation. While its financials seem promising, the high P/E ratio and lack of FII data require careful consideration. Savvy investors can potentially explore it after in-depth due diligence and understanding the valuation. Amateur investors should prioritize safer options unless they have a moderate risk tolerance and have conducted thorough research.

Navigating Penny Stock Investments

While FII endorsements can add credibility to penny stock investments, it’s essential for individual investors to conduct their own due diligence.

Thorough research, risk assessment, and a well-defined investment strategy are crucial when considering penny stocks.

Additionally, diversification is key to mitigating risk, as investing solely in penny stocks can expose one to significant volatility.

Read more:

Paytm Share Price Crash! Verge of Becoming a Penny Stock

Penny Stocks For Dummies: Step by Step Ultimate Guide

Best Penny Stocks For Budget 2024: Unlocking Opportunities

Conclusion

Penny stocks present a compelling opportunity for investors seeking high returns, especially when endorsed by reputable institutions like FIIs.

By exploring the top FII holding penny stocks and understanding the reasons behind their selection, investors can gain valuable insights into potential investment opportunities.

However, it’s essential to approach penny stock investing with caution, conducting thorough research and maintaining a diversified portfolio to manage risk effectively.

With the right strategy and diligence, penny stocks backed by FIIs could prove to be lucrative additions to an investment portfolio.

Disclaimer: The information provided here is for educational purposes only and should not be considered as financial advice. Always consult with a qualified financial advisor before making investment decisions.