Is your company facing a formal lawsuit or any third-party claim? In the event of a business-related lawsuit, your personal finances are always at risk. So, cover your company with business liability insurance that protects it from serious damages and avoid undue losses.

Moreover, if you are a startup, then having general liability insurance let you work stress-free. Protecting your business doesn’t cost you much and you can focus on your job as well.

You might also interested to read:

Facts Behind Cheque Bounce Will Haunt You Forever

Decoding – Business Liability Insurance

Business liability insurance provides you with awesome financial protection especially if you are a small business owner. It is because proprietor and business partners tend to put their own personal finances in business.

Once you cover your company, it gives you stability in your business. Business liability insurance protects your company and pays for any legal obligations.

Moreover, it also covers any damage done to the property or injury caused due to your company or by any employee. It includes the medical cost that accidentally happened because of your business.

Furthermore, it also protects you from any legal defence or any lawsuit against your company. You can also cover your business as a tenant, in case of fire or any other way that might damage the rented property.

Moreover, liability insurance also covers you on any false claims or misleading advertising, and copyright infringement.

Read Also:

5 Best Car Insurance Policy in India 2018 and Save Upto 70%

Protect Your Business – Cost

Coverage levels and cost may depend upon what type of business you have. Suppose you have a manufacturing unit and so your coverage levels and the cost will be higher. On the other hand, if you provide any services then normally it may cost you lower.

If your business risk is low, then you might consider a

Business Owner’s Policy (BOP). A BOP is specifically designed for small and medium-sized businesses. It actually offers you a budget-friendly premium that bundled with general and property liability insurance.

So, instead of buying a separate policy, you can opt for BOP which will be a more cost-effective option.

If you need additional coverage to protect your personal property such as garages or storage facilities, then you can get it in a BOP.

Business Liability Insurance – Claims

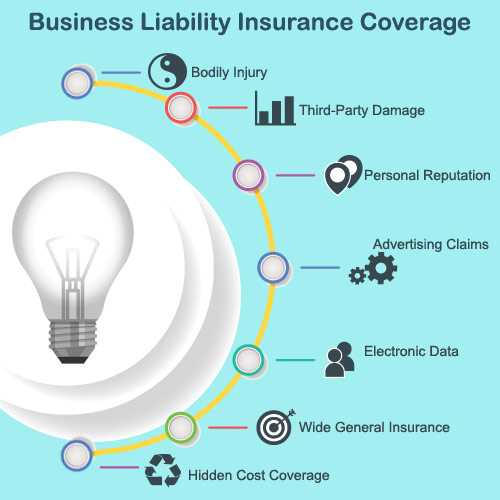

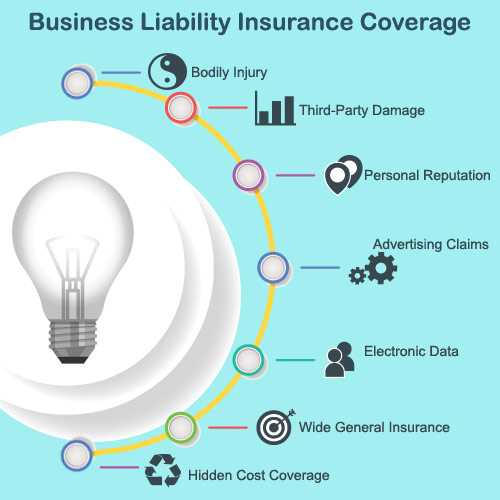

General liability insurance can protect you from any claims that can arise from your business operations. It includes bodily injury, damage to property, personal injury, advertising, copyright infringement, and others.

Bodily Injury

No matter, how careful you are as accidents and injuries are beyond your control. Even if you have planned properly or taken the best precautions to avoid undue circumstances.

Suppose your client or any other person injured because of your business. So, if you have general liability insurance then it will cover the claims for any bodily injury.

It is very useful if you’re running any infrastructure, real estate, heavy engineering, factories, or any other business. You can expect bodily injury that can happen at any time on job sites.

In case your client slipped and accidentally broke his arms and later claim for his bodily injury. So, in that case, general liability insurance also protects your business.

Third-Party Damage

If you or your employees are responsible for any third-party damage, then it will surely create a big hole in your pocket. So, it’s wise for you to shield yourself and your business with a general insurance policy.

General insurance companies covered you for damages done to third-party due to your any business activity. It will protect your business if you are legally liable for and not for your own property.

For instance, suppose you have a construction business. While doing some job, your worker accidentally breaks the frontage of a store while handling earth moving equipment. So, your business is liable to compensate that store owner.

Read Also:

Financial Planning: 5 Reasons Why People Avoid Doing It

Personal Reputation Claims

Personal reputation claims arise when you or your employees make any false statement in written or in electronic mode. If the statement damages a person’s reputation, then you are liable to compensate him.

Moreover, if your statement is verbal and false that put dirt on someone’s reputation, then your business may also get affected. So, it is better to have business liability insurance to protect against any such claims.

Small and mid-sized businesses may suffer a lot as they may not follow work ethics. Your employees may involve in a discussion where they make a false statement. At the end your business likely to face the consequences because of claims.

Advertising Claims

Advertising injury can protect you from using unintended third-party’s advertising idea. If you use any advertising ideas without knowing it then general liability insurance will protect your business.

So, if you are a marketing professional then beware of using third-party’s copyright works. In case you use it mistakenly then business liability insurance can come to rescue your business.

Electronic Data Liability Claims

General liability insurance also covers your business and protect you from electronic data liability claims. Damaging third-party digital data along with physical asset may lead you to face serious consequences.

Suppose you have a team of IT professional and damages a server while working for a client. In that case, all data may be lost and cannot be recovered. Imagine the situation and you may not have any clue what your client going to do.

Your client may sue you and your employee for data loss. In such a situation business liability insurance may provide you with some kind of relief. Apart from electronic data coverage, it also covers you for damages done to premises, rented, and advertising injury.

You know what! Electronic data are more important than any other physical properties. So, if you are running a business related to consultancies like IT & ITES, education, HR, marketing, or any other, then you must ensure it.

Even some insurer also covers medical expenses for job site injury to you and your employees. Injury can happen at any time on the job especially in construction or electrical works.

If you are a small business owner, then it will be very difficult for you to cope up with the expenses. Moreover, medical and legal expenses due to injury may soar easily. So, a general liability insurance policy protects yourself and your business.

Your business will suffer because of one mistake was done by your employee. It really doesn’t matter, whether your employee is engaged as full-time or temporary.

Hidden Cost Coverage

While defending a claim against your business, you may incur some expenses. This hidden cost may also be covered by the insurer to your business.

You may be covered for the loss of your earning while assisting in the claim investigation process. Whether you are a consultant, marketer, or doing construction business, business insurance can rescue you.

Wide General Insurance Coverage

Business liability insurance covers you if your business requires you and your team to travel across the world. It may happen as your business demand travels on a regular basis to fulfil your client’s needs.

Some insurer covers you for short travel periods for work purpose outside your job location. As a small business owner, general insurance act as a shield for you and your employees. So, if you travel lots, then worldwide insurance coverage definitely benefits you.

What is Not Covered

Business liability insurance does not cover any claims for your own property or other’s property if it is in your custody. You won’t get covered, if you own and use an automobile, aircraft, and any other medium.

Furthermore, personally identifiable information which may be under your control also not covered. Remember that sensitive information is much more valuable than any other property.

General liability insurance also not cover any unprofessional services. Suppose a claim has been made because of improper advice or suggestion. In addition, if your employees harm themselves on the job, then also it may not be covered.

Do I Need General Liability Insurance

If you are a small business owner, then I suggest you cover your business as soon as possible to safeguard it. Moreover, a single incident might change the entire scenario of your business. So, it is better to protect your business before you lose out any.

Furthermore, some of your clients might also need you to have general liability insurance before you start working for them.

How Business Liability Insurance Works

Suppose someone files a lawsuit against your company. He claims for $ 200,000 for medical costs and an additional $75,000 as legal fees. However, your insurance covers you only $250,000. So, in that case, you might need to pay the difference of $25,000.

In case you need excess coverage, then you can increase your coverage limits. By doing so, you can protect your business in a situation where your existing coverage might not cover all costs.

So, research your business before you apply for an insurance policy. As different business types have different coverage.

Intimate Your Insurance Company

If a situation arises that may lead to a claim, then you must notify your insurance company immediately. You may need to explain them in detail. So, you need to keep all the information, witnesses, and any other relevant and valuable data.

Do I Need Any Other Insurance

Apart from business liability insurance, you may also need a state disability insurance and compensation insurance. In addition, you may also need to have an auto, home based business, environmental insurance, and more. However, what insurance you need is totally depends on the nature of your business.

So, are you insured your business? If not then go ahead and get yourself one.

What difficulties have you faced before you insured your business? You can share your experience with us so that we may get to know the real world from real people like you. Your experiences may also help other business owners to take a decision.

You can express your views, suggestion, and real experiences in the below comment section.

If you like this post, then kindly share it on your social networks and help others to protect their business from undue injury.

Published on: Sep 08, 2018