Do you know the key elements of any day trading strategy?

It is nothing but a trend.

I am sure you heard about the famous quote “Trend is your friend”

However, you may be wondering how trend becomes your friend.

It is because when you trade with the trend, your chances of success will be more.

Your trading outcome will be awesome if you follow the trend instead of forecasting market direction. However, identifying the trend is not so easy, even if you use trend indicators.

Suppose, in a daily chart the trend is up and in the hourly chart, the trend is down. Moreover, the trend is rangebound when you switch to a 5-Minute chart.

Read also:

Stock Market Day Trading Tips : Pre Opening Trade Setup [2019]

6 Awesome Tricks To Select Stocks For Day Trading in 1 Min

Crossover Day Trading Strategy: Ultimate Trade Set Up [2019]

Day Trading Strategies: 5 Best Trending Stocks For Intraday

So, how will you determine the trend?

In fact, the trend is changing with what timeframe you choose. So, a trend is useless without knowing your timeframe.

You may have uptrend views on the same market and your friend may have a downtrend view. It is because both of you may be looking at different timeframes.

So, before you identify the direction of the trend, you must know your timeframe.

You’re probably wondering which timeframe should you use now.

What timeframe you choose is totally depends on your goal and what you want to achieve. If you’re a day trader, then smaller time frame of not more than 15 Minutes is ideal.

However, I prefer to use 5 Minutes timeframe for my day trading strategy.

Likewise, if you’re a swing trader, then 1 Hour to 4 Hours timeframe is best. Moreover, if you’re a long-term investor, then best timeframe will be 1 Day.

So, you need to tweak your day trading strategy a little bit. Before you do anything, just analyse your trading goals and then choose the timeframe.

You can easily identify the trend with any trend indicator once you finalise your timeframe.

In this post, we will empower our day trading strategy with two powerful trend indicators.

These two indicators not only help you to identify the trend but it also lets you to quickly find your entry and exit point.

You will be amazed after implementing this awesome intraday trading strategy.

These two indicators are VWAP and Supertrend. VWAP is nothing but Volume-Weighted Average Price.

I assume you know about these two indicators and their features. So, without wasting your time lets quickly move onto the strategy.

Rules of VWAP and Supertrend day trading strategy:

Strategy: Day Trading/Scalping

Chart Settings:

Timeframe: 5 Minutes

Chart Types: Candlestick

Indicator 1: VWAP

Indicator 2: Supertrend(7,3), Supertrend(10,3), Supertrend(11,2)

Intraday Trade Setup for Buy or Long

You need to go long when the price moves and crosses above all the indicators. Moreover, the closing price of the breakout candle must be above these indicators.

You need to place a buy order just above the High of the breakout candle. Your buy order will trigger if the second candle breaks the previous candle’s High.

Make sure you enter your trade as much close to VWAP as possible

Your Stop Loss will be the low of the previous candle or Supertrend(11,2). Your target or exit plan will depend on your greed.

However, I suggest you take 0.5% to 1% as profit targets in day trading. You can also trail your stop loss by using Supertrend(11,2) or VWAP itself.

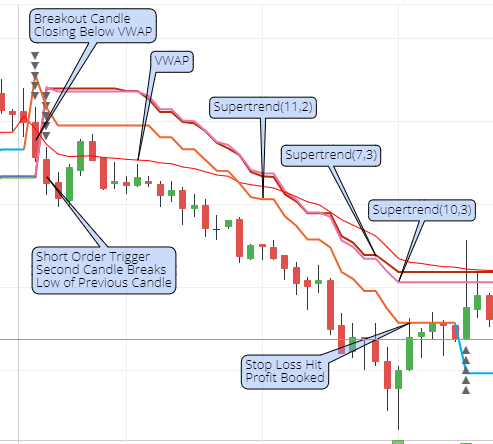

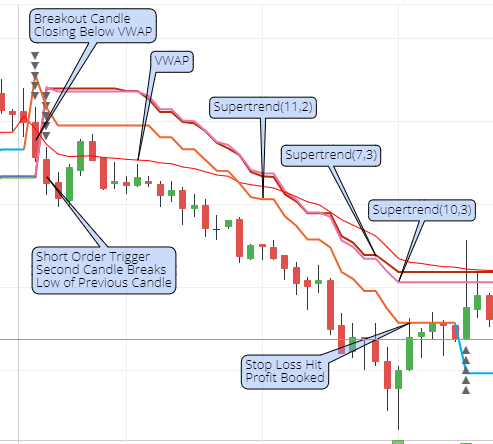

Short Rules

You can go short when the price moves and crosses below all the indicators. Moreover, the closing price of the breakout candle must be below these indicators.

You need to place a short order just below the Low of the breakout candle. Your short order will trigger if the second candle breaks the previous candle’s Low.

While shorting, make sure you enter your trade as much as close to VWAP as possible

Your Stop Loss will be the High of the previous candle, Supertrend(11,2) or VWAP.

This is my favourite day trading strategy and provides a great result.

VWAP is meant for intraday trading only and so you won’t find VWAP in your daily timeframe chart.

However, before you implement this awesome intraday trade setup you must backtest it.

Which day trading strategy do you use to churn money from the stock market?

Either way, do share your views on this strategy in the comment section.

If you like this post, then don’t forget to share it on your social networks.

Published on: June 04, 2019

Make sure you enter your trade as much close to VWAP as possible

Your Stop Loss will be the low of the previous candle or Supertrend(11,2). Your target or exit plan will depend on your greed.

However, I suggest you take 0.5% to 1% as profit targets in day trading. You can also trail your stop loss by using Supertrend(11,2) or VWAP itself.

Make sure you enter your trade as much close to VWAP as possible

Your Stop Loss will be the low of the previous candle or Supertrend(11,2). Your target or exit plan will depend on your greed.

However, I suggest you take 0.5% to 1% as profit targets in day trading. You can also trail your stop loss by using Supertrend(11,2) or VWAP itself.

While shorting, make sure you enter your trade as much as close to VWAP as possible

Your Stop Loss will be the High of the previous candle, Supertrend(11,2) or VWAP.

This is my favourite day trading strategy and provides a great result. VWAP is meant for intraday trading only and so you won’t find VWAP in your daily timeframe chart.

However, before you implement this awesome intraday trade setup you must backtest it.

Which day trading strategy do you use to churn money from the stock market?

Either way, do share your views on this strategy in the comment section.

If you like this post, then don’t forget to share it on your social networks.

Published on: June 04, 2019

While shorting, make sure you enter your trade as much as close to VWAP as possible

Your Stop Loss will be the High of the previous candle, Supertrend(11,2) or VWAP.

This is my favourite day trading strategy and provides a great result. VWAP is meant for intraday trading only and so you won’t find VWAP in your daily timeframe chart.

However, before you implement this awesome intraday trade setup you must backtest it.

Which day trading strategy do you use to churn money from the stock market?

Either way, do share your views on this strategy in the comment section.

If you like this post, then don’t forget to share it on your social networks.

Published on: June 04, 2019