Power is the backbone of any economic growth and development of nations. In India, power is generated from various sources of energy. Conventional sources of energy are coal, natural gas, oil, hydro, lignite, nuclear and non-conventional sources such as wind and solar. Multibagger stock NLC India is one of the pioneering power generating organization that contributes to the development of new India.

More Multibagger stock Ideas: How Multibagger Stock Vedanta Can Double Your Money Get 380% Return On Multibagger Jackpot Stock SAILPower consumption in India is rising rapidly and expected to rise further in the future. India ranks 3rd in Renewable Energy Country Attractive Index. It happens because of strong reforms brought by the Government of India. Furthermore, India also ranks 26th in the World list of electricity accessibility in 2017.

About Multibagger Stock NLC

NLC India is a Navratna company and was incorporated as a private limited by the Government of India. It undergoes mining and processing of lignite, generating and also distributing power. Furthermore, it also manufactures fertilizer and chemicals. Its main businesses are mining and power generation.

NLC India comes under the Ministry of Coal Government of India and supplies power to the southern part of India. It supplies to the states of Tamil Nadu, Andhra Pradesh, Karnataka, Kerala, Telangana, Rajasthan, and UT of Puducherry.

Presently NLC operates in four lignite mines having a total capacity of 30.60 Million Tonnes per annum (MTPA). Its thermal power plants have a capacity of 3240 MegaWatt (MW). Furthermore, it also commissioned a coal-based power plant of 1000 MW. In fact, NLC also installed a solar power plant of 10 MW and wind power plant of 30 MW capacity. Apart from lignite mining, NLC generates power from coal, solar, wind energy

NLC India Share Holding Pattern

Promoters of multibagger stock NLC India holds more than 89% stake. Financial institutions and GoI holds around 4% in it. NLC India is also included in Bharat22 Exchange Traded Fund and sentiments are positive across all investors class for it.

Multibagger Stock NLC and Its Competitors

| Name of the Stocks | Market Cap. (Rs. cr.) | Total Assets |

| NTPC | 146,398.22 | 115,833.98 |

| Power Grid Corp | 109,130.96 | 126,386.29 |

| NHPC | 27,648.87 | 27,140.14 |

| Tata Power | 24,058.96 | 27,788.40 |

| NLC India | 15,996.47 | 17,370.06 |

| SJVN | 14,312.73 | 13,271.54 |

| CESC | 13,317.34 | 18,547.08 |

| JSW Energy | 13,210.64 | 11,315.99 |

| Adani Power | 13,210.02 | 29,947.52 |

| Torrent Power | 12,633.01 | 15,072.84 |

| Reliance Infra | 11,536.06 | 33,595.64 |

| Reliance Power | 10,364.94 | 23,468.23 |

| Suzlon Energy | 7,288.09 | 6,908.45 |

| Jaiprakash Pow | 4,317.12 | 19,501.51 |

| DPSC | 3,310.89 | 1,863.13 |

| Inox Wind | 3,032.51 | 3,580.27 |

| Schneider Infra | 3,000.76 | 463.76 |

| GVK Power | 2,558.32 | 1,853.37 |

| Rattan Power | 2,244.23 | 11,626.21 |

| Guj Ind Power | 1,930.72 | 2,548.15 |

| BF Utilities | 1,763.03 | 142.36 |

| Rattan Infra | 1,271.69 | 680.06 |

| Orient Green | 654.72 | 944.32 |

| KSK Energy Vent | 349.79 | 3,802.90 |

| Energy Dev | 94.29 | 196.42 |

| Entegra | 88.80 | 547.20 |

| Mitcon Cons | 75.02 | 92.12 |

| Indowind Energy | 73.14 | 249.35 |

| Karma Energy | 44.60 | 88.76 |

| Advance Meter | 38.38 | 189.88 |

| S E Power | 34.52 | 91.65 |

| KKV Agro Powers | 14.51 | 8.56 |

| Bil Energy | 7.93 | 103.28 |

Currently, NLC market cap is above 16K crore and P/E ratio is 12.06. It has given more than 38 percent of returns in the last year itself. It is one of the top 5 company in the power generation business in terms of market cap.

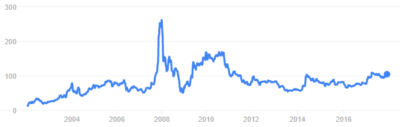

Technical Analysis

Currently, NLC India is trading at around 105 and the trend for the last one year is bullish. It starts moving upward from 65 and hit 122.90 in a year itself and returned almost double. It is in strong resistance zones and is in verge to breakout. So, you can start buying multibagger stock NLC India at around 110 and hold with a Stop Loss of 85.

You can hold it for a short-term target of 140 followed by 180. Keep trailing your Stop Loss from 85 and once it reached any of the targets then book full or partial profit. However, I suggest you remain invested in this counter for a long term. My final target is 280 and if you willing to invest then hold it as it is one of the safest bet.

In case, it correct from 105, then you can enter at around 85 levels for a short-term target of 100. Put a Stop Loss below 85 to avoid any loss.

If you like this multibagger stock idea, then share it on your social networks like Facebook, Twitter, and Google+. You can share your views and opinion on multibagger stock NLC India in the comments section.